Deathcross in the time of coronavirus

This won’t make a ton of sense without reading the previous articles in this series. (Part 1) (Part 2) They’re quick reads, if you want a refresher.

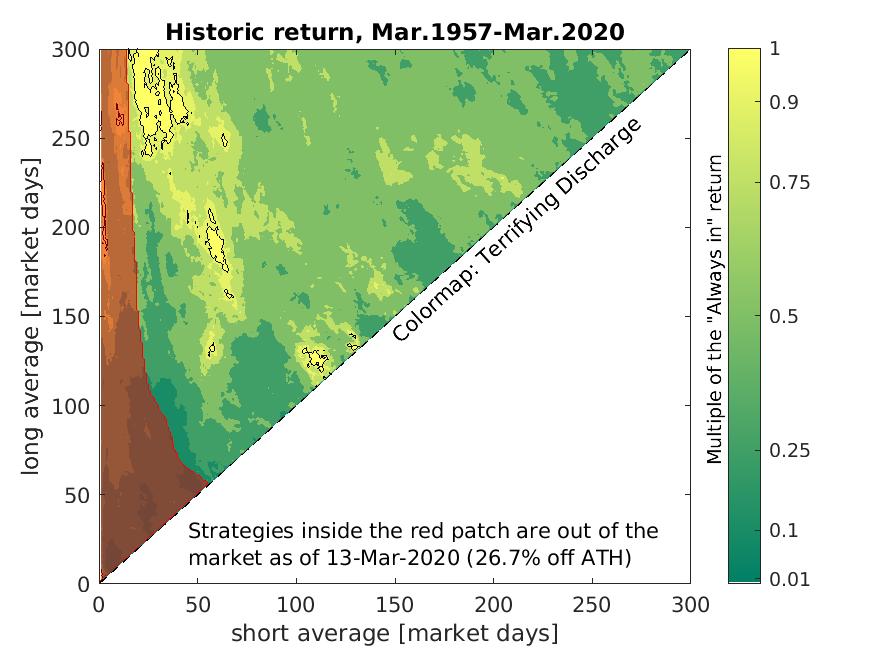

At the time of writing, the S&P 500 index is 26.7% below its all time high. It was a rapid descent, including the four largest daily point drops, and the fifth-highest point drop by percentage. Much like Black Monday in 1987, you wouldn’t expect Deathcross strategies to pull you out of the market immediately. Since we have code which computes the results of the strategy for every combination of long and short averages up to 300 days, we might as well check which ones would have pulled out of the market.

- 8.3% of the strategies would have pulled their money out at this point.

- It’s not obvious that the strategies that would have pulled out would all be in a single contiguous region, but I suspect it’s because the speed of the decline has been so rapid compared to the run-up. If the market goes sideways for a little while, this probably won’t hold anymore.

- Anecdata: There’s not much discussion about these strategies during this decline, relative to late 2018. Probably because there are better things to talk about.

- One of the few pieces I’ve seen calls out the 200 day moving average compared to an intraday price, which is close to the 200/1 deathcross. Per the linked article, that strategy triggered on 27-Feb. (Edit, 21-Mar: There it is.)

- As usual, the question of whether a strategy works isn’t going to be answered until we know when it would get back in. You may expect a followup or two.

Practice social distancing, and wash your hands. The latter you should be doing anyway, and for once you (Aren) can chalk up the former to pandemic mitigation rather than a unilateral decision that other people are making because you (again, Aren) keep rambling about what key a robot would sing in.